SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x☒ Filed by a Party other than the Registrant ¨☐ Check the appropriate box:

|

| | | | | |

¨☐ | | Preliminary Proxy Statement |

| |

¨☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

x☒ | | Definitive Proxy Statement |

| |

¨☐ | | Definitive Additional Materials |

| |

¨☐ | | Soliciting Material Pursuant to§240.14a-11(c) §240.14a-11(c) or§240.14a-2 §240.14a-2 |

| Expedia, Inc. |

Expedia, Inc. |

| (Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

| Payment of Filing Fee (Check the appropriate box): |

| |

x☒ | | No fee required. |

| |

¨☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | (1)(1 | ) | | Title of each class of securities to which transaction applies: |

| | (2 | ) | | |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3 | ) | | |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange ActRule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4 | ) | | |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5 | | |

| | (5)) | | Total fee paid |

| | |

| | | | |

| | | | |

| |

¨☐ | | Fee paid previously with preliminary materials. |

| |

¨☐ | | Check box if any part of the fee is offset as provided by Exchange ActRule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1)(1 | ) | | Amount Previously Paid: |

| | (2 | ) | | |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3 | ) | | Filing Party: |

| | (3)(4 | ) | | Filing Party:

|

| | | | |

| | (4) | | Date Filed: |

| | | | |

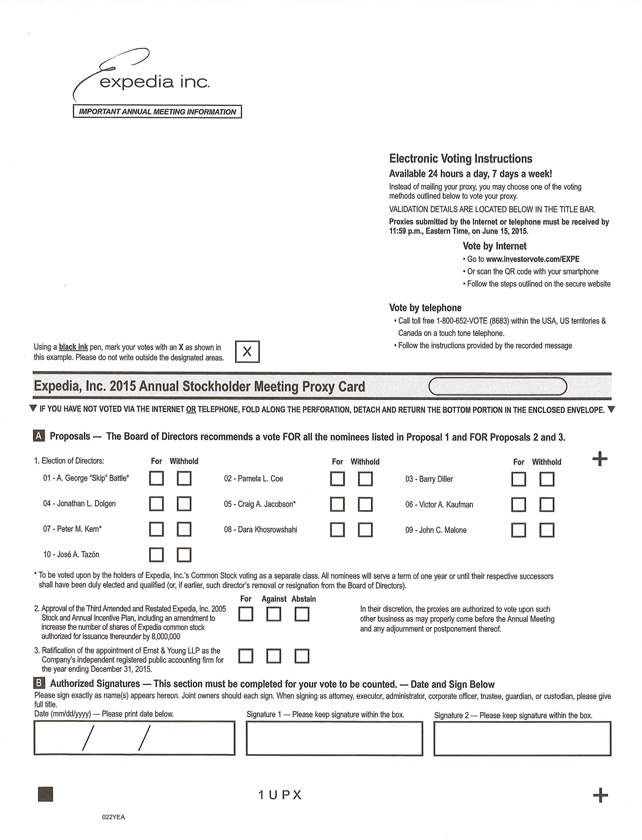

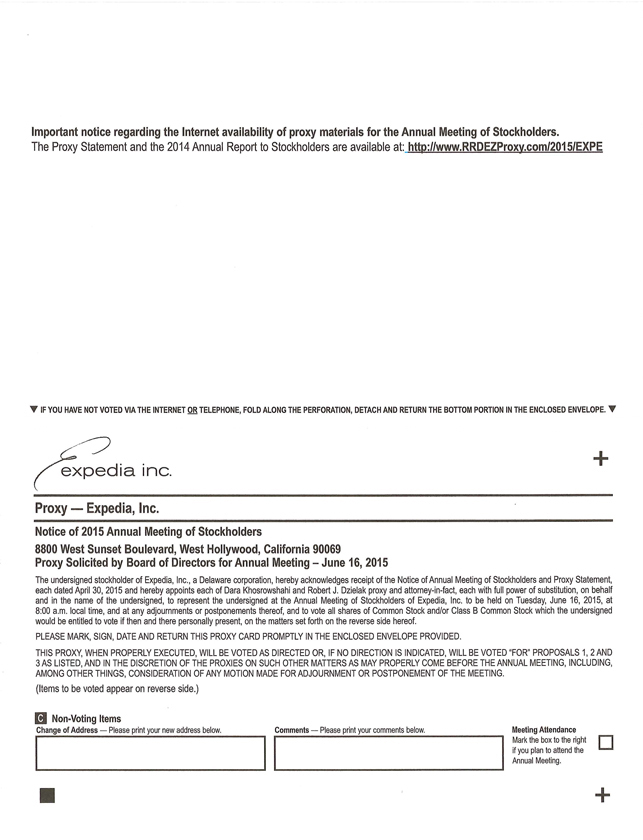

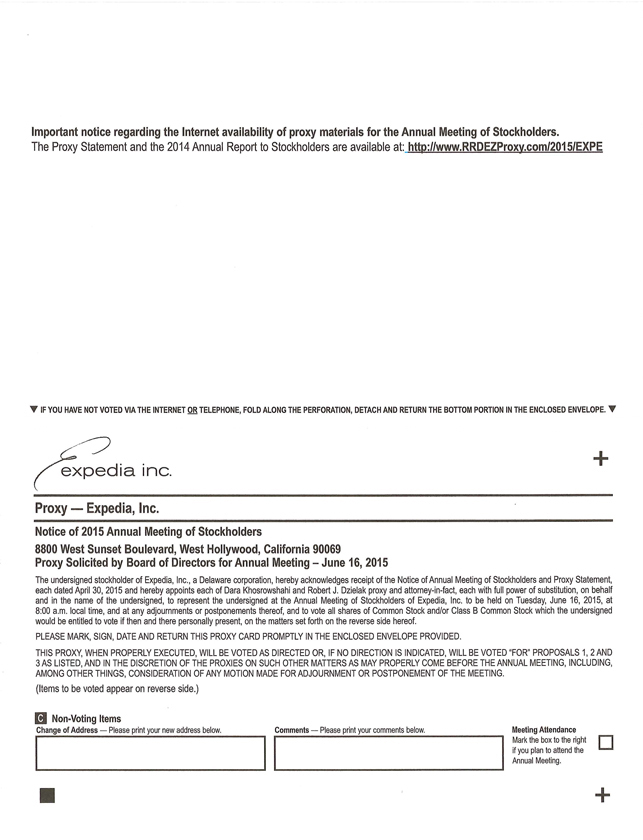

April 30, 2015

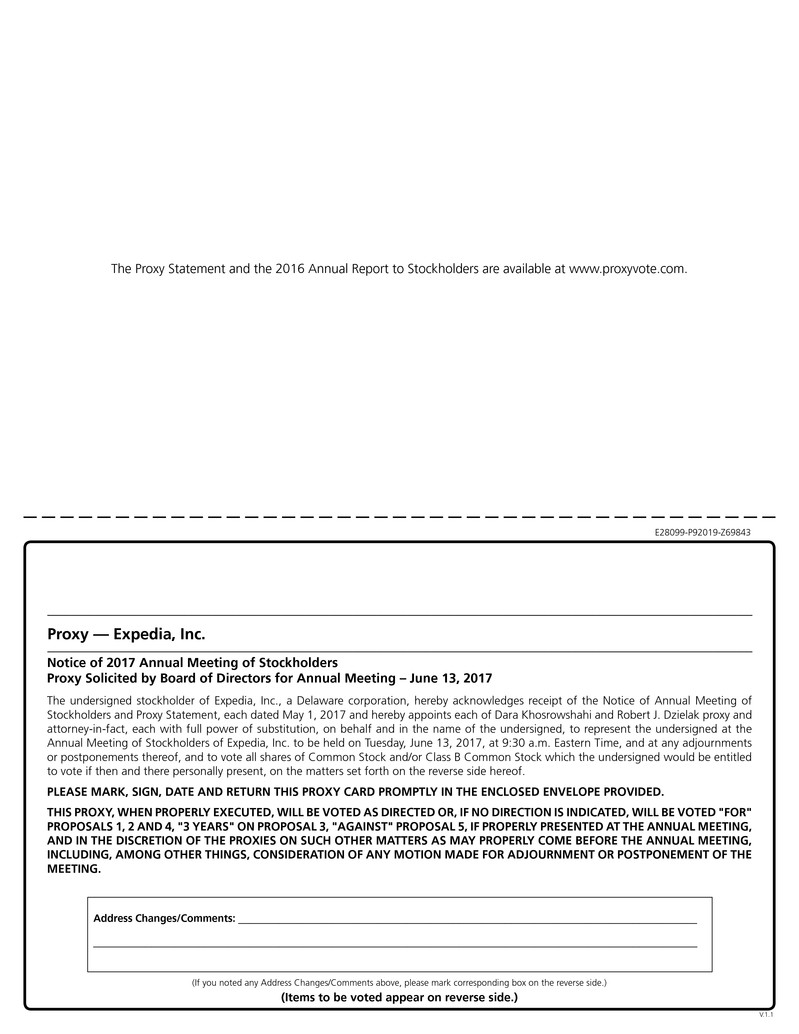

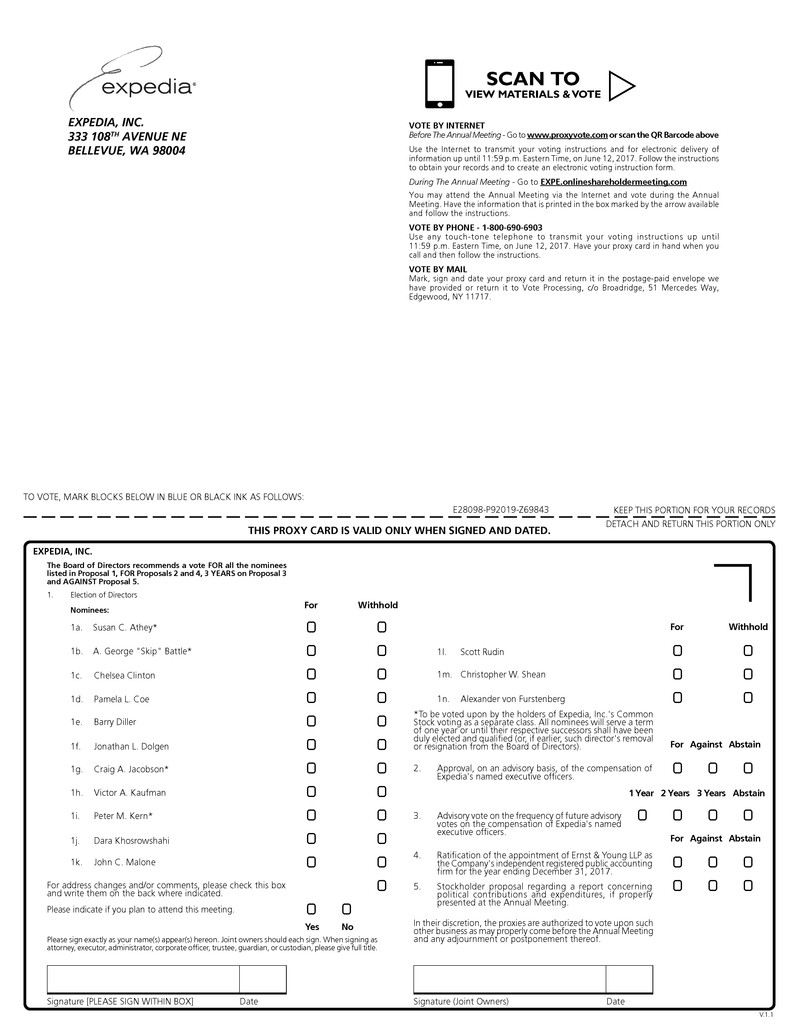

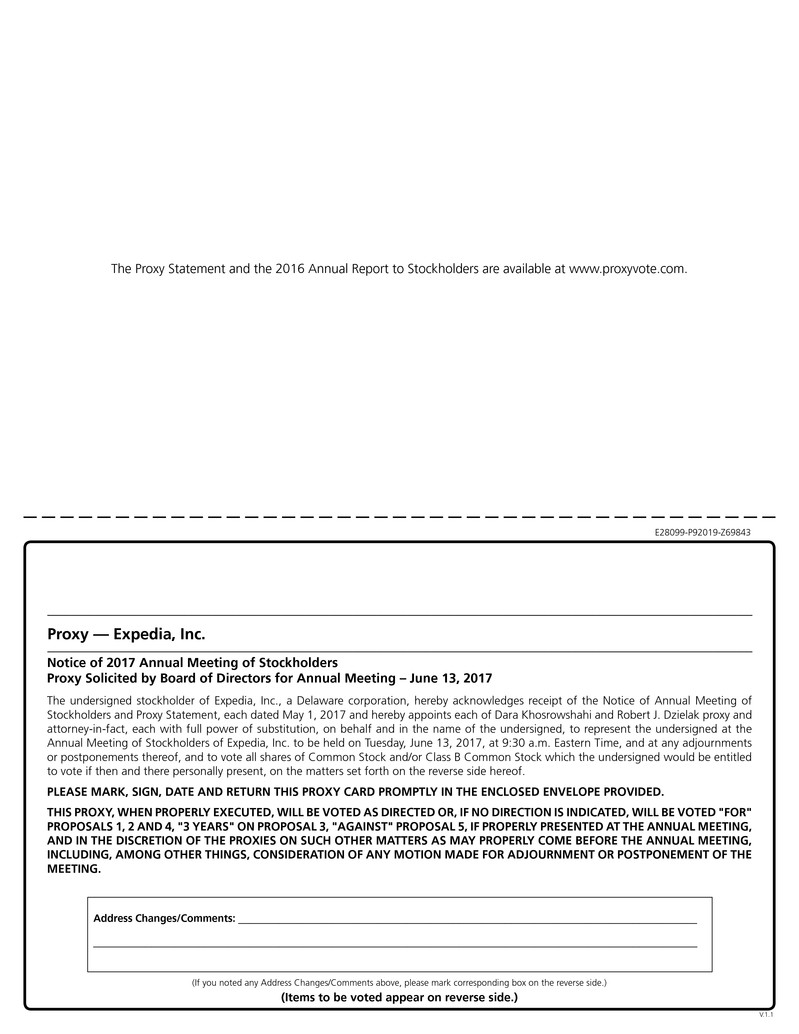

May 1, 2017

You are invited to attend the Annual Meeting of Stockholders of Expedia, Inc., which will be held on Tuesday, June 16, 2015,13, 2017, beginning at 8:009:30 a.m. local time at 8800 West Sunset Boulevard, West Hollywood, California 90069.At theEastern Time. This year’s Annual Meeting you will be asked (1)a completely virtual meeting, conducted solely online. You will be able to elect ten directors, (2)attend the virtual Annual Meeting by logging in at

www.EXPE.onlineshareholdermeeting.com. We are excited to approve the Third Amended and Restated Expedia, Inc. 2005 Stock and Annual Incentive Plan, including an amendmentembrace technology to increase stockholder accessibility, while improving meeting efficiency and reducing costs. The attached Proxy Statement provides information on how to participate in the

number of2017 virtual Annual Meeting, how to vote your shares,

of Expedia common stock authorized for issuance thereunder by 8,000,000, and

(3)explains the matters to

ratify the appointment of Ernst & Young LLP as Expedia’s independent registered public accounting firm for 2015. The Board of Directors unanimously recommends that you vote FOR each of the nominees listedbe voted upon in

item 1, and FOR items 2 and 3.detail.

Your vote is very important. Whether or not you plan to attend the

virtual Annual Meeting

online, please take the time to vote. You may vote over the internet, as well as by telephone, or, if you requested to receive printed proxy materials, by mailing a proxy or voting instruction card. If you

attendparticipate in the

virtual Annual Meeting, you may

also vote

in personyour shares online at that time if you wish, even

thoughif you have previously submitted your

vote.vote (other than shares held through the Company’s 401(k) plan, which must be voted prior to the meeting).

|

Sincerely,

|

| Sincerely, |

|

President and Chief Executive Officer Bellevue, Washington 98004 |

STOT

Bellevue, Washington 98004

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

The 2017 Annual Meeting of Stockholders of Expedia, Inc., a Delaware corporation, will be held online on Tuesday, June 16, 2015,13, 2017, at 8:009:30 a.m. local timeEastern Time. There will be no physical location for stockholders to attend. Stockholders may only participate by logging in at 8800 West Sunset Boulevard, West Hollywood, California 90069.www.EXPE.onlineshareholdermeeting.com. Items of business at the Annual Meeting will be:

| |

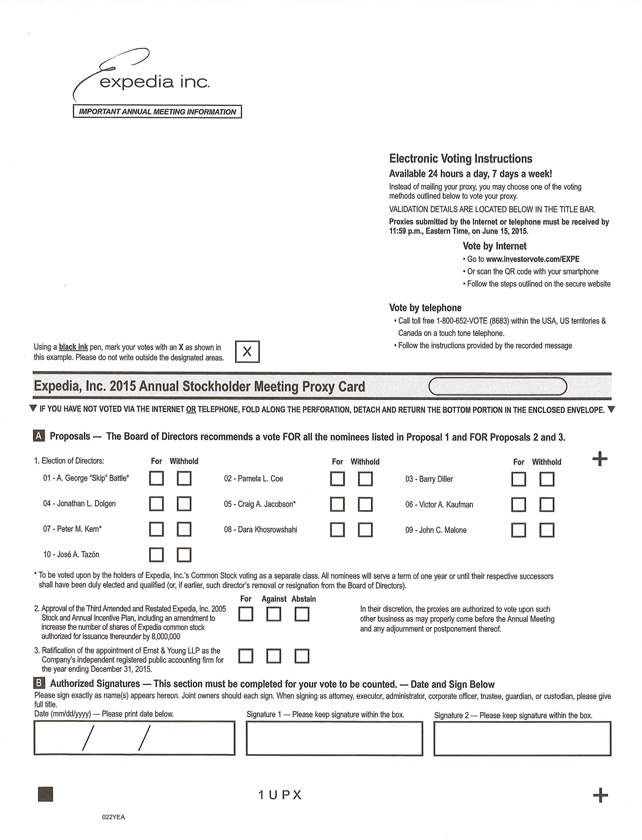

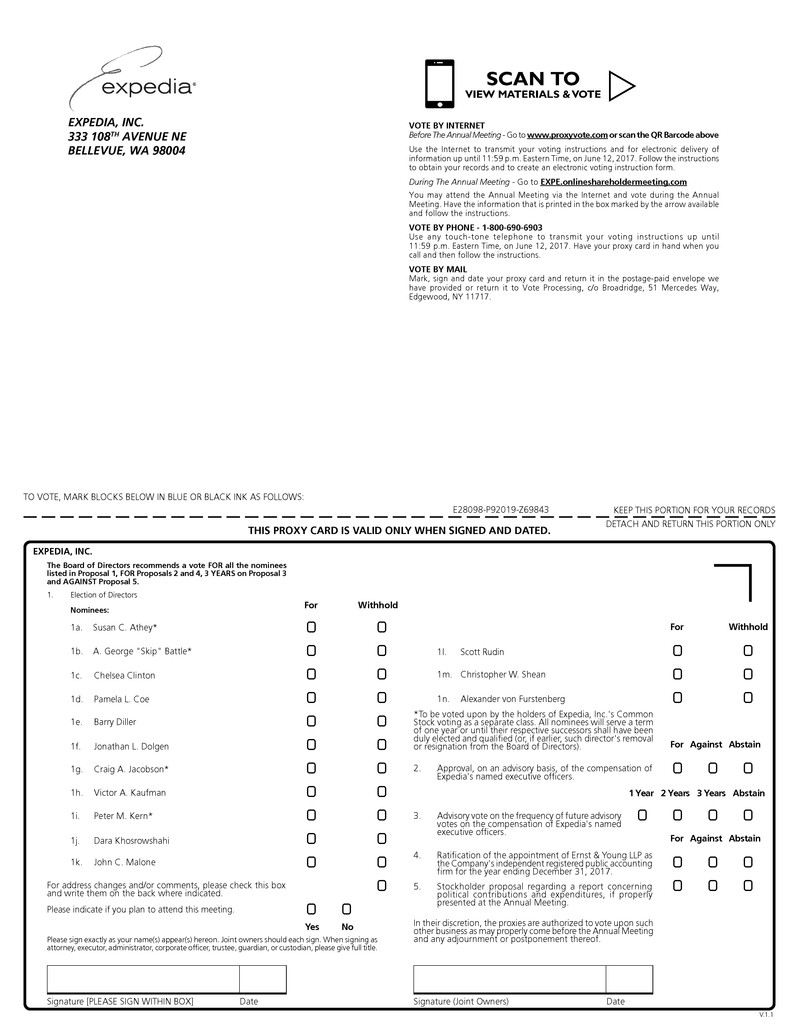

| 1. | To elect the tenfourteen directors named in this proxy statement, each to hold office for a one-year term ending on the date of the next annual meeting of stockholders or until such director’s successor shall have been duly elected and qualified (or, if earlier, such director’s removal or resignation from the Board of Directors); |

| |

| 2. | To approvehold an advisory vote on Expedia’s executive compensation; |

| |

| 3. | To hold an advisory vote on the Third Amended and Restated Expedia, Inc. 2005 Stock and Annual Incentive Plan, including an amendment to increasefrequency of the number of shares of Expedia common stock authorized for issuance thereunder by 8,000,000;advisory vote on Expedia’s executive compensation; |

| 3. |

| 4. | To ratify the appointment of Ernst & Young LLP as Expedia’s independent registered public accounting firm for 2015;2017; |

| |

| 5. | To consider a stockholder proposal on political contributions and expenditures, if properly presented at the Annual Meeting; and |

| 4. |

| 6. | To transact such other business as may properly come before the Annual Meeting and any adjournments or postponements thereof. |

Voting.Only holders of record of outstanding shares of Expedia capital stock at the close of business on April 17, 20152017 are entitled to notice of to attend, and to vote at the Annual Meeting and any adjournments or postponements thereof. Whether or not you plan to attend the Annual Meeting virtually, please consider voting prior to the meeting at

www.Proxyvote.com, call 1-800-690-6903 or complete, sign, date and return the proxy card. Returning the proxy card does not deprive you of your right to attend and to vote your shares during the virtual Annual Meeting. Proxy Materials. We are furnishing proxy materials to our stockholders primarily via the internet instead of mailing printed copies of those materials to each stockholder. By doing so, we save costs and reduce the environmental impact of our Annual Meeting. On or about April 30, 2015,May 1, 2017, we will send a Notice of Internet Availability of Proxy Materials to the holders of record and beneficial owners of our capital stock as of the close of business on the record date and also provide access to our proxy materials over the internet.Only stockholders and persons holding proxies from stockholders may attend the Annual Meeting. If your shares are registered in your name, you should bring a form of photo identification to the Annual Meeting. If your shares are held in the name of a broker, bank or other holder of record, you will need to bring a proxy or letter from that broker, bank or other holder of record that confirms you are the beneficial owner of those shares, together with a form of photo identification.

|

|

| By order of the Board of Directors, |

|

|

Executive Vice President, General Counsel and Secretary |

April 30, 2015

May 1, 2017

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Stockholders to Be Held on June

16, 201513, 2017

This Proxy Statement and the 20142016 Annual Report are available at:

www.Proxyvote.comwww.RRDEZProxy.com/2015/EXPE

Table of Contents

This Proxy Statement is being furnished to holders of common stock and Class B common stock of Expedia, Inc., a Delaware corporation, in connection with the solicitation of proxies by Expedia’s Board of Directors for use at its

20152017 Annual Meeting of Stockholders or any adjournment or postponement thereof.

Expedia’s principal offices are located at 333 108th Avenue N.E., Bellevue, Washington 98004. This Proxy Statement is being made available to Expedia stockholders on or about

April 30, 2015.May 1, 2017.

Virtual Annual Meeting Information

Date Time and Place of MeetingTimeThe. This year, the Annual Meeting will be held "virtually" through an audio webcast on Tuesday, June 16, 2015,13, 2017 at 8:009:30 a.m. local, Eastern Time. There will be no physical meeting location. The meeting will only be conducted via an audio webcast.

Access to the Audio Webcast of the Annual Meeting. The audio webcast of the Annual Meeting will begin promptly at 9:30 a.m., Eastern Time. Online access to the audio webcast will open approximately thirty minutes prior to the start of the Annual Meeting to allow time at 8800 West Sunset Boulevard, West Hollywood, California 90069.Only stockholdersfor you to log in and persons holding proxies from stockholders maytest your computer audio system. We encourage you to access the meeting prior to the start time.

Log in Instructions. To attend the virtual Annual Meeting. IfMeeting, log in at www.EXPE.onlineshareholdermeeting.com. You will need your shares are registeredunique control number included in your name, you must bring a formNotice of photo identificationInternet Availability of Proxy Materials, on your proxy card (printed in the box and marked by the arrow) or on the instructions that accompanied your proxy materials.

Submitting Questions at the virtual Annual Meeting. Once online access to the Annual Meeting. IfMeeting is open, shareholders may submit questions, if any, on www.EXPE.onlineshareholdermeeting.com. You will need your unique control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card (printed in the box and marked by the arrow) or on the instructions that accompanied your proxy materials. Questions pertinent to meeting matters will be answered during the meeting, subject to time constraints.

Voting Your Shares at the virtual Annual Meeting. Unless you hold your shares are held in the name of a broker, trust, bank or other nominee, otherwise known as holding in “street name,”Company’s 401(k) plan, you must bring a proxy or letter from that broker, trust, bank or other nominee that confirms you are the beneficial owner of thosemay vote your shares together with a form of photo identification. Use of cameras and recording devices will not be permitted at the virtual Annual Meeting.Meeting even if you have previously submitted your vote. For instructions on how to do so, see the section below titled “

Voting Your Shares - Voting at the Virtual Annual Meeting.” The Board of Directors established the close of business on April 17,

20152017 as the record date for determining the holders of Expedia stock entitled to notice of and to vote at the Annual Meeting. On the record date,

114,762,076138,146,990 shares of common stock and 12,799,999 shares of Class B common stock were outstanding and entitled to vote at the Annual Meeting.

Transaction of business at the Annual Meeting may occur if a quorum is present. If a quorum is not present, it is expected that the Annual Meeting will be adjourned or postponed in order to permit additional time for soliciting and obtaining additional proxies or votes, and, at any subsequent reconvening of the Annual Meeting, all previously submitted proxies will be voted in the same manner as such proxies would have been voted at the original convening of the Annual Meeting, except for any proxies that have been effectively revoked or withdrawn.

The presence at the Annual Meeting, in person or by proxy, of the holders of a majority of the total votes entitled to be cast by holders of Expedia common stock and Class B common stock at the 20152017 Annual Meeting constitutes a quorum. Stockholders who participate in the Annual Meeting online at www.EXPE.onlineshareholdermeeting.com will be considered to be attending such meeting in person for purposes of determining whether a quorum has been met. In the election of the threefour directors whom the holders of Expedia common stock are entitled to elect as a separate class, the presence at the Annual Meeting, in person or by proxy, of the holders of a majority of votes of the outstanding common stock constitutes a quorum. If a share is represented for any purpose at the meeting, it is deemed to be present for quorum purposes and for all other matters as well. Shares of Expedia stock represented by a properly executed proxy will be treated as present and entitled to vote at the Annual Meeting for purposes of determining a quorum, without regard to

whether the proxy is marked as casting a vote or abstaining.

Voting Rights

Expedia stockholders Abstentions and broker non-votes are therefore counted as present and entitled to one vote for each sharepurposes of common stock and ten votes for each share of Class B common stock held as of the record date, voting together asdetermining a single voting group, in:

quorum.the election of seven of the ten director nominees,

the approval of the Third Amended and Restated Expedia, Inc. 2005 Stock and Annual Incentive Plan (the “Amended 2005 Plan’); and

Voting Rightsthe ratification of the appointment of Expedia’s independent registered public accounting firm.

-1-

Expedia stockholders are entitled to one vote for each share of common stock held as of the record date in the election of the three director nominees that the holders of Expedia common stock are entitled to elect as a separate class pursuant to the Company’s amended and restated certificate of incorporation.

Barry Diller, the Chairman and Senior Executive of Expedia, generally controls the vote of shares that he owns as well as, pursuant to an irrevocable proxy, those shares beneficially owned by Liberty Interactive Corporation (“Liberty Interactive”) and its subsidiaries. Based on information filedprovided on a Schedule 13D/A13D filed by Mr. Diller and Liberty InteractiveExpedia Holdings, Inc. (“Liberty Expedia Holdings”), on October 8, 2014,November 14, 2016, and on a Form 4 filed by Mr.Barry Diller on March 15, 2013, and a Form 4 filed by Liberty Interactive on April 14, 2015 referencing shares subsequently purchased on April 21, 2015,February 24, 2017, Mr. Diller and Liberty InteractiveExpedia Holdings together beneficially own approximately 14%12% of the outstanding shares of common stock (or 24%approximately 19% assuming exercise of Mr. Diller’s vested stock options and conversion of all shares of Class B common stock into shares of common stock) and 100% of the outstanding shares of Class B common stock and, consequently, approximately 60%54% of the combined voting power of the outstanding Expedia capital stock as of the record date. As a result, regardless of the vote of any other Expedia stockholder, Mr. Diller has historically directly controlled a majority voting interest in Expedia though an irrevocable proxy over all such shares not directly held by him (the “Diller Proxy”). Mr. Diller temporarily assigned the Diller Proxy to Liberty Expedia Holdings until the earlier of May 4, 2018 and certain termination events. While the assignment is in effect, as a result of the governance arrangements at Liberty Expedia Holdings and various agreements among Mr. Diller, Liberty Expedia Holdings and certain other parties, Mr. Diller has the ability to control overindirectly the vote relating tovoting of the Expedia shares held by Liberty Expedia Holdings and its subsidiaries on the election of seven ofExpedia directors. For further information on the ten director nominees,Company’s relationship with Mr. Diller, see the ratification ofsection below titled “Certain Relationships and Related Person Transactions- Relationships Involving Significant Stockholders, Named Executive Officers and Directors-Relationships Involving Mr. Diller”. For further information on the appointment of Expedia’s independent registered public accounting firm,Company’s relationship with Liberty Expedia Holdings, see the vote, on an advisory basis, on Expedia’s executive compensationsection below titled “Certain Relationships and the stockholder proposal on political contributionsRelated Person Transactions- Relationships Involving Significant Stockholders, Named Executive Officers and expenditures, if properly presented at the Annual Meeting.

Directors-Relationships Involving Liberty Expedia Holdings

”.

Expedia will bear the cost of the solicitation of proxies from its stockholders. In addition to solicitation by mail, the directors, officers and employees of Expedia, without additional compensation, may solicit proxies from stockholders by telephone, by letter, by facsimile, in person or otherwise. Following the original mailing of the proxies and other soliciting materials, Expedia will request brokers, trusts, banks or other nominees to forward copies of the proxy and other soliciting materials to persons for whom they hold shares of Expedia capital stock and to request authority for the exercise of proxies. In such cases, Expedia, upon the request of the brokers, trusts, banks and other stockholder nominees, will reimburse such holders for their reasonable expenses.

Voting Your Shares

Voting by Proxy

Without Attending the Virtual Annual Meeting

You may direct how your shares are voted by proxy, without attending the Annual Meeting. The manner in which your shares may be voted by proxy depends on whether you are a:

| • | | Registered stockholder:your shares are represented by certificates or book entries in your name on the records of the Company’s stock transfer agent;

|

| • | | 401(k) plan participant: your shares are held in Expedia’s 401(k) plan for employees; or

|

| • | | Beneficial stockholder:you hold your shares “in street name” through a broker, trust, bank or other nominee.

|

Registered stockholder: your shares are represented by certificates or book entries in your name on the records of the Company’s stock transfer agent;

401(k) plan participant: your shares are held in Expedia’s 401(k) plan for employees; or

Beneficial stockholder: you hold your shares “in street name” through a broker, trust, bank or other nominee.

You may vote your shares by proxy in any of the following three ways:

| • | | Using the Internet. Registered stockholders and 401(k) plan participants may vote using the internet by going to www.Proxyvote.com and following the instructions. Beneficial stockholders may vote by accessing the website specified on the voting instruction forms provided by their brokers, trusts, banks or other nominees. You will be required to enter the control number that is included on your Notice of Internet Availability of Proxy Materials or other voting instruction form provided by your broker, trust, bank or other nominee. Online proxy voting via the internet is available 24 hours a day and will close 11:59 p.m., Eastern Time, on June 12, 2017. Using the Internet. Registered stockholders and 401(k) plan participants may vote using the internet by going towww.investorvote.com/EXPE and following the instructions. Beneficial stockholders may vote by accessing the website specified on the voting instruction forms provided by their brokers, trusts, banks or other nominees. You will be required to enter the control number that is included on your Notice of Internet Availability of Proxy Materials or other voting instruction form provided by your broker, trust, bank or other nominee.

|

By Telephone. Registered stockholders and 401(k) plan participants may vote, from within the United States, using any touch-tone telephone by calling 1-800-652-VOTE (8683)1-800-690-6903 and following the recorded instructions. Beneficial owners may vote, from within the United States, using any touch-tone telephone by calling the number specified on the voting instruction forms provided by their brokers, trusts, banks or other nominees. You will be required to enter the control number that is included on your Notice of Internet Availability of Proxy Materials or other voting instruction form provided by your broker, trust, bank or other nominee. Telephone proxy voting is available 24 hours a day and will close 11:59 p.m., Eastern Time, on June 12, 2017.

-2-

| trusts, banks or other nominees. You will be required to enter the control number that is included on your Notice of Internet Availability of Proxy Materials or other voting instruction form provided by your broker, trust, bank or other nominee.

|

By Mail. Registered stockholders and 401(k) plan participants may submit proxies by mail by requesting printed proxy cards and marking, signing and dating the printed proxy cards and mailing them in the accompanying pre-addressed envelopes. Beneficial owners may vote by marking, signing and dating the voting instruction forms provided and mailing them in the accompanying pre-addressed envelopes.

All proxies properly submitted and not revoked will be voted at the Annual Meeting in accordance with the instructions indicated thereon. If you are a stockholder of record and submit your proxy voting instructions but do not direct how to vote on each item, the persons named as proxies will vote as the Board recommends on each of the proposals described in this Proxy Statement.

Expedia is incorporated under Delaware law, which specifically permits electronically transmitted proxies, provided that each such proxy contains, or is submitted with, information from which the inspector of elections can determine that such proxy was authorized by the stockholder (Delaware General Corporation Law section 212(c)). The electronic voting procedures provided for the Annual Meeting are designed to authenticate each stockholder by use of a control number, to allow stockholders to vote their shares, and to confirm that their instructions have been properly recorded.

For information on how to vote during the Annual Meeting, see the section above titled “Virtual Annual Meeting Information - Submitting Questions and Voting During the Annual Meeting.”

Voting at the Virtual Annual Meeting.

Unless you hold your shares in the Company’s 401(k) plan, you may also vote your shares at the virtual Annual Meeting even if you have previously submitted your vote. To vote at the virtual Annual Meeting, log in at www.EXPE.onlineshareholdermeeting.com. You will need your unique control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card (printed in the box and marked by the arrow) or on the instructions that accompanied your proxy materials. If you are the beneficial owner of shares held through a broker, or other nominee, please follow the instructions provided by your broker, trustee or nominee.

Because shares held by participants in the Company’s 401(k) plan must be voted by the trustee, these shares may not be voted during the Annual Meeting. You will, however, be able to attend the virtual Annual Meeting and submit questions.

Voting in PersonImpact of Abstentions and Broker Non-Votes

Abstentions. Abstentions are treated as shares entitled to vote and, as a result, have the same effect as a vote against any proposal for which the voting standard is based on the number of shares present at the Annual MeetingYou may also (the two advisory proposals regarding Expedia’s executive compensation, the auditor ratification proposal and the stockholder proposal on political contributions and expenditures) and have no impact on the vote in personon any proposal for which the vote standard is based on the votes cast at the meeting (the election of directors).

Broker non-votes. Broker non-votes are not treated as shares entitled to vote and, as a result, have no effect on the outcome of any of the proposals to be voted on by stockholders at the Annual Meeting. Votes in person will replace any previous votes youMeeting; provided, however, that brokers have made by mail, telephone or the internet. We will provide a ballot to registered stockholders who request one at the meeting. Shares held in your name as the stockholder of record may be voted on that ballot. Shares held beneficially in street name may be voted on a ballot only if you bring a legal proxy from the broker, trust, bank or other nominee that holds your shares giving you the rightdiscretionary authority to vote on the shares. Attendance at the Annual Meeting without voting or revoking a previous proxy in accordance with the voting procedures will not in and of itself revoke a proxy.Abstentions and Broker Non-Votes

Abstentions and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum.

auditor ratification proposal. If you hold Expedia shares in street name or in Expedia’s 401(k) Plan, you must provide your broker, bank or other holder of record with instructions in order to vote these shares. If you do not provide voting instructions to your bank, broker or other nominee, whether your shares can be voted by such person depends on the type of item being considered for a vote.

vote:

Non-Discretionary Items. The election of directors, the two advisory proposals regarding Expedia’s executive compensation and the approval of the Amended 2005 Planpolitical contributions and expenditures proposal are non-discretionary items and may NOT be voted on by your broker, bank or other nominee absent specific voting instructions from you. Discretionary Items. The ratification of Ernst & Young LLP as Expedia’s independent registered public accounting firm for 20152017 is a discretionary item. Generally, brokers, banks and other nominees that do not receive voting instructions may vote on this proposal in their discretion. The trustee of Expedia’s 401(k) plan for employees, Fidelity Management Trust Company, will vote Expedia common stock credited to employee accounts in accordance with such employees’ voting instructions. The trustee will vote the 401(k) plan stock for which voting instructions are not received in the same proportion as the shares for which voting instructions are received.

-3-

If you are a beneficial stockholder, you may revoke your proxy or change your vote only by following the separate instructions provided by your broker, trust, bank or other nominee.

If you are a registered stockholder, you may revoke your proxy at any time before it is exercised at the Annual Meeting by (i) delivering written notice, bearing a date later than the proxy, stating that the proxy is revoked, or (ii) submitting a later-dated proxy relating to the same stock by mail, telephone or the internet prior to the vote at the Annual Meeting, or (iii) attending the

virtual Annual Meeting and

properly giving notice of revocation to the inspector of election or voting in person.resubmitting your vote. Registered

holdersstockholders may

send any written notice or request for a new proxy card to Expedia, Inc., c/o Computershare, P.O. Box 30170, College Station, TX 77842-3170, oralso follow the instructions provided on the Notice of Internet Availability of Proxy Materials and proxy card to submit a new proxy by telephone or via the internet.

Registered holders may also request a new proxy card by calling 1-866-202-9254.

The Board of Directors does not presently intend to bring any business before the Annual Meeting other than the proposals discussed in this Proxy Statement and specified in the Notice of Annual Meeting of Stockholders. The Board has no knowledge of any other matters to be presented at the Annual Meeting other than those described in this Proxy Statement. If any other matters should properly come before the Annual Meeting, the persons designated in the proxy will vote on them according to their best judgment.

Your vote is very important. Whether or not you plan to attend the Annual Meeting, please take the time to vote via the internet, by telephone or by returning your marked, signed and dated proxy card so that your shares will be represented at the Annual Meeting.

-4-

PROPOSAL 1:

ELECTION OF DIRECTORS

At the Annual Meeting, a board of tenfourteen directors will be elected to hold office until the next annual meeting of stockholders or until their successors shall have been duly elected and qualified (or, if earlier, any director’s removal or resignation from the Board of Directors). The Company’s amended and restated certificate of incorporation provides that the holders of the Company’s common stock, acting as a single class, are entitled to elect a number of directors equal to 25% percent of the total number of directors, rounded up to the next whole number of directors, which is currently threefour directors. The Board has designated Ms. Athey and Messrs. Battle, Jacobson and Kern as nominees for the positions on the Board to be elected by the holders of Expedia common stock voting as a separate class. Pursuant to an Amended and Restated Governance Agreement among Expedia, Liberty Interactive and Mr. Diller dated December 20, 2011, which was assigned to Liberty Expedia Holdings on November 4, 2016 (the “Governance Agreement”“Governance Agreement”), Liberty InteractiveExpedia Holdings has the right to nominate up to a number of directors equal to 20% of the total number of the directors on the Board (rounded up to the next whole number if the number of directors on the Board is not an even multiple of five) for election to the Board and has certain other rights regarding committee participation, so long as certain stock ownership requirements applicable to Liberty InteractiveExpedia Holdings are satisfied. Liberty InteractiveExpedia Holdings has designated Ms. Coe, Dr. Malone, and Ms. CoeMr. Shean as its nominees to the Board. Although management does not anticipate that any of the nominees named below will be unable or unwilling to stand for election, in the event of such an occurrence, proxies may be voted for a substitute nominee designated by the Board. The name and certain background information regarding each nominee, as of April 1, 2015,2017, are set forth below. ThereExcept as noted, there are no family relationships among directors or executive officers of Expedia. In addition to the information presented below regarding each nominee’s specific experience, qualifications, attributes and skills that led the Board of Directors to the conclusion that he or she should be nominated as a director, each nominee has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment to Expedia and our Board as demonstrated by the nominee’s past service. AllSeveral of our director-nominees also have extensive management experience in complex organizations. The Board considered the NASDAQ requirement that the Company’s Audit Committee be composed of at least three independent directors, as well as specific NASDAQ and Securities and Exchange Commission (“SEC”SEC”) requirements regarding financial literacy and expertise. | | | |

| | |

Name | Age | Age | | | Position With Expedia, Inc. |

Barry Diller | | | 73 | | 75 | Chairman and Senior Executive |

Victor A. Kaufman | | | 71 | | 73 | Director and Vice Chairman |

Dara Khosrowshahi | | | 45 | | 47 | Director and Chief Executive Officer |

Susan C. Athey | 46 | Director |

| A. George “Skip” Battle | | | 71 | | 73 | Director |

Pamela L. Coe

Chelsea Clinton | | | 55 | | 37 | Director |

JonathanPamela L. Dolgen

Coe | | | 69 | | 57 | Director |

Craig A. Jacobson

Jonathan L. Dolgen | | | 62 | | 71 | Director |

Peter M. Kern

Craig A. Jacobson | | | 47 | | 64 | Director |

John C. Malone

Peter M. Kern | | | 74 | | 49 | Director |

José A. Tazón

John C. Malone | 76 | Director |

| Scott Rudin | 7258 | Director |

| Christopher W. Shean | 51 | Director |

| Alexander von Furstenberg | 47 | Director |

Barry Diller

Mr. Diller has been the Chairman of the Board and Senior Executive of Expedia since the completion of the Company’s spin-off from IAC/InterActiveCorp (“IAC”IAC”) on August 9, 2005 (the “IAC/“IAC/Expedia Spin-Off”Spin-Off”). Mr. Diller held the positions of Chairman of the Board and Chief Executive Officer of IAC/InterActiveCorpIAC and its predecessors since August 1995 and ceased serving as Chief Executive Officer in DecemberNovember 2010. Mr. Diller has served as Special Advisor to TripAdvisor, Inc., an online travel company, since April 2013 and served as its Chairman of the Board and Senior Executive from December 2011, when it was spun off from Expedia, Inc., until December 2012, and was a member of its Board until April 2013. Mr. Diller served as the non-executive Chairman of the Board of Ticketmaster Entertainment, Inc. from 2008 to 2010, when it merged with Live Nation,-5-

Inc. to form Live Nation Entertainment, Inc. Mr. Diller served as the non-executivenon-

executive Chairman of the Board of Live Nation Entertainment, Inc. from January 2010 to October 2010 and was a member of its Board until January 2011. He also served as Chairman of the Board and Chief Executive Officer of QVC, Inc. from December 1992 through December 1994 and as the Chairman of the Board and Chief Executive Officer of Fox, Inc. from 1984 to 1992. Prior to joining Fox, Inc., Mr. Diller served for ten years as Chairman of the Board and Chief Executive Officer of Paramount Pictures Corporation. Mr. Diller

is currentlyserved as a member of the

BoardsBoard of Directors of

The Coca-Cola Company and Graham Holdings Company (formerly The Washington Post Company)

. from November 2013 through January 2017. Mr. Diller is currently a member of the Board of Directors of the Coca-Cola Company. Mr. Diller is also a member of the

The Business Council, and serves on the Dean’s Council of The New York University Tisch School of the Arts, the Board of Councilors for the

School of Cinema-Television at the University of Southern

California’s School of Cinematic Arts, the New York University Board of Trustees,California and the

ExecutiveAdvisory Board for the

Medical Sciences of the University of California, Los Angeles and previously served as a member of the Council on Foreign Relations.Peter G. Peterson Foundation.

Board Membership Qualifications: As result of his involvement with Expedia both while it was operated within IAC and since the IAC/Expedia Spin-Off, Mr. Diller has a great depth of knowledge and experience regarding Expedia and its businesses. Mr. Diller has extensive management experience, broad international exposure and emerging market experience and innovation and technology experience, including through his service as Chief Executive Officer of media and interactive commerce companies, as well as experience as a director serving on other public company boards, including as Chairman. Mr. Diller also effectively controls Expedia.

Victor A. Kaufman

Mr. Kaufman has been a director and the Vice Chairman of Expedia since completion of the IAC/Expedia Spin-Off. Mr. Kaufman has been a director of IAC (and its predecessors) since December 1996 and has served as the Vice Chairman of IAC since October 1999. Mr. Kaufman served as a director of TripAdvisor, Inc. from the completion of the TripAdvisor Spin-Off until February 2013. Mr. Kaufman previously served as Vice Chairman of the Board of Ticketmaster Entertainment, Inc. from August 2008 through January 2010 and as a director of Live Nation Entertainment from January 2010 through December 2010. Mr. Kaufman served in the Office of the Chairman of IAC from January 1997 to November 1997 and as Chief Financial Officer of IAC from November 1997 to October 1999. Prior to his tenure with IAC, Mr. Kaufman served as the Chairman and Chief Executive Officer of Savoy Pictures Entertainment, Inc. from March 1992 and as a director of Savoy from February 1992. Mr. Kaufman was the founding Chairman and Chief Executive Officer of Tri-Star Pictures, Inc. and served in those capacities from 1983 until December 1987, at which time he became President and Chief Executive Officer of

Tri-Star’sTri- Star’s successor company, Columbia Pictures Entertainment, Inc. He resigned from those positions at the end of 1989 following the acquisition of Columbia by Sony USA, Inc. Mr. Kaufman joined Columbia in 1974 and served in a variety of senior positions at Columbia and its affiliates prior to the founding of Tri-Star.

Board Membership Qualifications: Mr. Kaufman has unique knowledge of and experience with Expedia and its businesses gained through his involvement with Expedia both while it was operated within IAC and since the IAC/Expedia Spin-Off. Mr. Kaufman also has a high level of financial literacy and expertise regarding mergers, acquisitions, investments and other strategic transactions, as well as experience as a director serving on other public company boards.

Dara Khosrowshahi

Mr. Khosrowshahihas been a director and the Chief Executive Officer of Expedia since completion of the IAC/Expedia Spin-Off. Mr. Khosrowshahi served as director of TripAdvisor, Inc., from the TripAdvisor Spin-OffSpin- Off until February 2013. Mr. Khosrowshahi served as the Chief Executive Officer of IAC Travel, a division of IAC, from January 2005 to the IAC/Expedia Spin-Off date. Prior to his tenure as Chief Executive Officer of IAC Travel, Mr. Khosrowshahi served as Executive Vice President and Chief Financial Officer of IAC from January 2002 to January 2005. Mr. Khosrowshahi served as IAC’s Executive Vice President, Operations and Strategic Planning, from July 2000 to January 2002 and as President, USA Networks Interactive, a division of IAC, from 1999 to 2000. Mr. Khosrowshahi joined IAC in 1998 as Vice President of Strategic Planning and was promoted to Senior Vice President in 1999. Mr. Khosrowshahi worked at Allen & Company LLC from 1991 to 1998, where he served as Vice President from 1995 to 1998. Mr. Khosrowshahi is currently a member of the Boards of Directors of elong,Fanatics Inc. and The New York Times Company, and of the Supervisory Board of trivago, N.V., a majority-owned subsidiary of Expedia, and Fanatics Inc.Expedia. Board Membership Qualifications: Mr. Khosrowshahi possesses in-depth experience with and knowledge of the online travel industry gained through his service as Chief Executive Officer of IAC Travel prior to the-6-

IAC/Expedia Spin-Off, as Chief Executive Officer of Expedia since the IAC/Expedia Spin-Off and as a director of TripAdvisor, Inc. following the TripAdvisor Spin-Off. Mr. Khosrowshahi also has a high level of financial literacy and expertise regarding mergers, acquisitions, investments and other strategic transactions.

Susan C. Athey

Professor Athey has been a director of Expedia since December 2015. Professor Athey is the Economics of Technology Professor at Stanford Graduate School of Business. Her research and teaching cover the economics of the internet and digital marketplaces, marketplace design, auctions, platform businesses, online advertising, the news media, financial technology, big data, and statistical methods for causal inference. She previously taught at the economics departments at MIT, Stanford and Harvard. In 2007, Professor Athey received the John Bates Clark Medal, awarded by the American Economic Association to “that American economist under the age of forty who is adjudged to have made the most significant contribution to economic thought and knowledge.” She was elected to the National Academy of Science in 2012 and to the American Academy of Arts and Sciences in 2008. She serves on the Board of Directors of Ripple, a financial services technology startup, and is an advisor to early stage venture capital fund X/Seed Capital and financial technology venture capital fund NYCA Partners. She received her bachelor’s degree from Duke University in economics, computer science, and mathematics and her Ph.D. in economics from Stanford. She holds an honorary doctorate from Duke University.

Board Membership Qualifications: Professor Athey brings to our board significant experience as leading expert in the field of economics of the internet and technology, having advised governments and businesses on marketplace design, platform strategy, big data, and financial technology, which are directly relevant to Expedia’s businesses. Professor Athey’s unique perspectives assist the board in developing strategies for the Company.

A. George “Skip” Battle

Mr. Battle has been a director of Expedia since completion of the IAC/Expedia Spin-Off. Mr. Battle previously served as the Executive Chairman of Ask Jeeves, Inc. from January 2004 through July 2005 and as its Chief Executive Officer from December 2000 until January 2004. Mr. Battle was a business consultant and investor and served as a member of the boards of directors of several technology companies from 1995 to 2000. Prior thereto, Mr. Battle served with Andersen Consulting in various roles, including Worldwide Managing Partner, Market Development, until his retirement from Andersen Consulting in 1995. Mr. Battle is currently Chairman of the

BoardCompensation Committee of Fair Isaac Corporation, a position he has held since

2002, and serves as lead independent director on the Board of Directors of LinkedIn Corporation, a position he has held since December 2010.2002. He is also a director of Netflix, Inc., Workday, Inc. and one nonprofit organization. Mr. Battle also served as a director of PeopleSoft, Inc. from 1995 until its acquisition by Oracle Corp. in 2004,

of Barra, Inc. from 1996 until 2004, Advent Software, Inc. from 2006 to May 2011, the Masters Select family of funds (all registered investment companies) from August 1996 until December 2012, Sungevity, Inc. from February 2010 until January 2013,

LinkedIn Corporation from December 2010 until December 2016 and

of OpenTable, Inc. from January 2006 until July 2014. Mr. Battle holds a B.A. in economics from Dartmouth College and an M.B.A. from the Stanford Graduate School of Business.

Board Membership Qualifications:Qualifications: Mr. Battle has extensive financial, strategic, operational, and corporate governance experience, acquired through his more than 25twenty-five years as a business consultant as well as his prior service as a chief executive officer. Mr. Battle also has experience as a director serving on other public company boards. Chelsea Clinton

Ms. Clinton has been a director of Expedia since March 2017. She has served as Vice Chair of the Clinton Foundation since March 2013, where her work emphasizes improving global and domestic health, creating service opportunities and empowering the next generation of leaders. Prior to assuming this role, Ms. Clinton served as a member of the Board of Directors of the Clinton Foundation from September 2011. Ms. Clinton has also served as a member of the Board of Directors of the Clinton Health Access Initiative since September 2011. From March 2010 through May 2013, Ms. Clinton served as an Assistant Vice Provost at New York University, where she focused on interfaith initiatives and the university’s Global Expansion Program. From November 2011 to August 2014, Ms. Clinton also worked as a special correspondent for NBC news. Prior to these efforts, Ms. Clinton worked as an associate at McKinsey & Company, a consulting firm, from August 2003 to October 2006, and as an associate at Avenue Capital Group, an investment firm, from October 2006 to November 2009. Ms. Clinton also currently serves on the Board of Directors of IAC, The School of American Ballet, the Africa Center and the Weill Cornell Medical College and as Co-Chair of the Advisory Board of the Of Many Institute at New York University. Ms. Clinton holds a B.A. from Stanford, an MPH from Columbia’s Mailman School of Public Health and both an MPhil and a Doctorate in International Relations from Oxford University.

Board Membership Qualifications: Ms. Clinton’s broad public policy experience, keen intellectual acumen and youthful perspective will further enhance the diversity of experience, backgrounds and opinions represented on the Board.

Pamela L. Coe

Ms. Coe has been a director of Expedia since November 2012. Ms. Coe is currently Senior Vice President, Deputy General Counsel and Secretary of Liberty Interactive, and Liberty Media Corporation (“Liberty Media”) and Liberty Broadband Corporation (“Liberty Broadband”), and has served inheld those capacities for more than the past five years. Shepositions since January 1, 2016. Prior to January 1, 2016, Ms. Coe was Vice President, Deputy General Counsel and Secretary of those companies. Ms. Coe also serves inheld those capacities forpositions with Liberty TripAdvisor Holdings, Inc. from August 2014 to April 2016.Ms. Coe is currently Senior Vice President, Deputy General Counsel and Secretary of Liberty Broadband Corporation.Expedia Holdings and has served as such from November 2016. Prior to joining Liberty, Ms. Coe served as Senior Counsel Finance at Liberty’s predecessor parent company, Tele-Communications, Inc. (“TCI”TCI”). Prior to her tenure at TCI, Ms. Coe was a partner in a major San Francisco-based law firm, specializing in corporate, securities and banking law. Board Membership Qualifications:Qualifications: Ms. Coe was nominated as a director by Liberty Interactive,Expedia Holdings, which currently has the right to nominate twothree individuals for election to Expedia’s Board of Directors pursuant to the Governance Agreement. Ms. Coe has significant legal and business knowledge and experience, including experience in corporate governance matters, securities law, and executive compensation and compliance matters.

Jonathan L. Dolgen

Mr. Dolgen has been a director of Expedia since completion of the IAC/Expedia Spin-Off. From July 2004 until April 2010, Mr. Dolgen was a Senior Advisor to Viacom, Inc. (“Old Viacom”), a worldwide entertainment and media company, where he provided advisory services to the chief executive officer of Old Viacom, or others designated by him, on an as-requested basis. Effective December 31, 2005, Old Viacom was separated into two publicly traded companies, Viacom Inc. (“New Viacom”) and CBS Corporation. From the separation of Old Viacom, Mr. Dolgen provided advisory services to the chief executive officer of New Viacom, or others designated by him, on an as-requested basis. Since July 2004, Mr. Dolgen has been a private investor, and since September 2004, Mr. Dolgen has been the principal of Wood River Ventures, LLC, a private entity that seeks investment and other opportunities, primarily in the media sector. From April 2005 until April 2013, Mr. Dolgen, through Wood River, had an arrangement with Madison Dearborn Partners, LLC to seek investment opportunities and consult, primarily in the media sector. From October 2006 through March 2008, Mr. Dolgen served as senior consultant for ArtistDirect, Inc.opportunities. From April 1994 to July 2004, Mr. Dolgen served as Chairman and Chief Executive Officer of the Viacom Entertainment Group, a unit of Old Viacom, where he oversaw various operations of Old Viacom’s businesses, which during 2003 and 2004 primarily included the operations engaged in motion picture productionParamount Pictures and distribution, television production and distribution,Paramount Television, Paramount’s regional theme parks, theatrical exhibition and publishing. As a result of the separation of Old Viacom, Old Viacom’s-7-

motion picture productiontheaters, and distribution and theatrical exhibition business became part of New Viacom’s businesses, and substantially all of the remaining businesses of Old Viacom overseen by Mr. Dolgen remained with CBS Corporation.book publishing operations. Mr. Dolgen began his career in the entertainment industry in 1976 and, until joining the Viacom Entertainment Group, served in a variety of executive positions at Columbia Pictures Industries, Inc., Twentieth Century Fox and Fox, Inc., and Sony Pictures Entertainment. Mr. Dolgen has also been a director of Live Nation Entertainment, Inc. since its formation following the merger of Live Nation, Inc. and Ticketmaster in January 2010. Prior to the merger, Mr. Dolgen was a director of Ticketmaster from August 2008. From October 2004 until September 2008, Mr. Dolgen was a director of Charter Communications, Inc. He is also a member of the Board of Trustees of California Institute of the Claremont Graduate SchoolArts and a director of the Simon Wiesenthal Center. Mr. Dolgen holds a B.S. from Cornell University and a J.D. from New York University.

Board Membership Qualifications:Qualifications: Mr. Dolgen has extensive high-level executive management experience, including prior service as a Chief Executive Officer. Mr. Dolgen also has experience as a director serving on other public company boards. Mr. Dolgen has significant expertise in both traditional and new media.

Craig A. Jacobson

Mr. Jacobson has been a director of Expedia since December 2007. Mr. Jacobson is a founding partner at the law firm of Hansen, Jacobson, Teller, Hoberman, Newman, Warren, Richman, Rush,

Kaller &

Kaller,Gellman, L.L.P., where he has practiced entertainment law for

more than the past 25 years. Mr. Jacobson is a member of the Board of Directors of Charter Communications,

andInc., Tribune Media

Company.Company and New Form Digital, a digital content studio, partially owned by ITV and Discovery Communications. Mr. Jacobson was a director of Ticketmaster from August 2008 until its merger with Live Nation, Inc. in January 2010, Aver Media, a privately-held Canadian lending institution, and Eventful Inc., digital media company.

Mr. Jacobson is a founder of New Form Digital, a venture with Discovery Communications, focusing on short form digital content.

Board Membership Qualifications:Qualifications: Mr. Jacobson has extensive legal and business knowledge and experience in corporate governance matters. Mr. Jacobson also has significant financial knowledge gained during his more than twenty-five years practicing law as well as his service as a director serving on public and private company boards.

Peter M. Kern

Mr. Kern has been a director of Expedia since completion of the IAC/Expedia Spin-Off. Mr. Kern is a Managing Partner of InterMedia Partners VII, LP, a private equity firm. Prior to joining InterMedia, Mr. Kern was Senior Managing Director and Principal of Alpine Capital LLC. Prior to Alpine Capital, Mr. Kern founded Gemini Associates in 1996 and served as President from its inception through its merger with Alpine Capital in 2001. Prior to founding Gemini

Associates, Mr. Kern was at the Home Shopping Network and Whittle Communications.

Since April 2013, Mr. Kern has served

on the Board of Directors of Tribune Media Company since October 2016, as Chairman of the Board of Directors of Hemisphere Media Group, Inc., a publicly-traded Spanish-language media

company.company, since April 2013, and since December 2016, as a member of the Board of Directors of trivago N.V. Mr. Kern also serves on the boards of a number of private companies, including Luxury Retreats International Holdings, Inc. and Up Entertainment, LLC. Mr. Kern holds a B.S. degree from the Wharton School at the University of Pennsylvania.

Board Membership Qualifications: Through his extensive background in private equity and as a director of several private companies, as well as prior experience in senior executive positions, Mr. Kern has a high level of financial expertise and background in analyzing investments and strategic transactions.

John C. Malone

Dr. Malone has been a director of Expedia since completion of the IAC/Expedia Spin-Off, other than for a brief period in November/December 2012. Dr. Malone has served as the Chairman of the Board and a director of Liberty Interactive Corporation (including its predecessors) since 1994, as Chairman of the Board of Liberty Media Corporation (including its predecessors)predecessor) since August 2011 and as a director since December 2010,2010. He served as the Chief Executive Officer of Liberty Interactive (including its predecessors) from August 2005 to February 2006. Dr. Malone served as the Chairman of the Board of TCI from November 1996 until March 1999, when it was acquired by AT&T., and as Chief Executive Officer of TCI from January 1994 to March 1997. Dr. Malone has served as a director and the Chairman of the Board of Liberty TripAdvisor Holdings, Inc.Interactive since 2014 and as1994, the Chairman of the Board of Liberty Broadband Corporation since November 2014. He served as2014, the Chairman of the Board of Liberty Interactive Corporation’s Chief Executive Officer from August 2005 through February 2006. Dr. Malone has also served asExpedia Holdings since November 2016, the Chairman of the Board of Liberty Global plc (“LGP”) since June 2013, having previously served as the Chairman of the Board of Liberty Global plc’sLGP’s predecessor, Liberty Global, Inc., from June 2005 to June 2013. Dr. Malone has also served as2013, a director of Discovery Communications, Inc., since September 2008. He2008, a director of Discovery Holding Company from May 2005 to September 2008 and as Chairman of the Board from March 2005 to September 2008, a director of Charter Communications, Inc. since May 2013 and a director of Lions Gate Entertainment Corp. since March 2015. Dr. Malone previously served as: (i)as a director of Ascent Capital Group, Inc. from January 2010 to September 2012, (ii) a director of Live Nation Entertainment, Inc. from January 2010 to February 2011, (iii) the Chairman of the Board of DIRECTV from November 2009 to June 2010, and DIRECTV’s predecessor, The DIRECTV Group, Inc., from February 2008 to November 2009,-8-

(iv) a director of IAC/InterActiveCorp from May 2006 to June 2010, (v) a director of Discovery Holding Company, from May 2005 to September 2008, and as Chairman of the Board from March 2005 to September 2008, and (vi) a director of Sirius XM Radio Inc. from April 2009 to May 2013.

2013, a director of IAC from May 2006 to June 2010 and the Chairman of the Board of Liberty TripAdvisor Holdings, Inc. from August 2014 to June 2015.

Board Membership Qualifications:Qualifications: Dr. Malone was nominated as a director by Liberty Interactive,Expedia Holdings, which currently has the right to nominate twothree individuals for election to Expedia’s Board of Directors pursuant to the Governance Agreement. Dr. Malone is a leaderconsidered one of the preeminent figures in the media and telecommunications industry and has extensive senior executive experience as well as experience as a director serving on other public company boards. He is also well known for his sophisticated problem solving and risk assessment skills.José A. Tazón

Scott Rudin

Mr. Rudin has been a director of Expedia since March 2009. Since January 1, 2009,June 2016. Mr. TazónRudin is an award-winning film and theatre producer. Mr. Rudin began his career in the entertainment industry in the 1970s, and since then has served in a variety of roles, including as founder and principal of Scott Rudin Productions and as a senior executive at Twentieth Century Fox. While at Twentieth Century Fox and subsequently during a 15-year partnership with Paramount Pictures and a collaboration with Walt Disney Studios under its Walt Disney Pictures and Miramax Films labels, Mr. Rudin produced a large number of critically acclaimed and commercially successful films. In addition, over the course of the past decade Mr. Rudin has produced numerous award-winning theatrical productions. In 2011, Mr. Rudin was awarded the David O. Selznick Achievement Award in Motion Pictures which recognizes an individual’s outstanding body of work in the field of motion picture production, and in 2012 he became one of the few individuals to have won an Emmy, Grammy, Oscar and Tony award, and the first producer to do so.

Board Membership Qualifications: Mr. Rudin’s extensive experience in the media and entertainment industry, as well as his business and marketing expertise, brings a unique perspective to the board.

Christopher W. Shean

Mr. Shean has been a director of Expedia since December 2015. He has served as the non-executive ChairmanChief Executive Officer and President of Liberty Expedia Holdings since March 2016 and as a director since November 2016. He has also served as a Senior Advisor of Liberty Interactive, Liberty Media and Liberty Broadband since October 2016. Mr. Shean

served as the Chief Financial Officer of Liberty Media (including its predecessor) from November 2011 to October 2016, Liberty Interactive from November 2011 to October 2016 and Liberty Broadband from June 2014 to October 2016. He has held a number of executive positions with Liberty Media since May 2007 and with Liberty Interactive since October 2000. Mr. Shean also served as a Senior Vice President of Liberty Broadband from June 2014 to December 2015. In addition, Mr. Shean served as Senior Vice President and Chief Financial Officer of Liberty TripAdvisor Holdings, Inc. from July 2013 to January 2016. Mr. Shean has served as a director of FTD Companies, Inc. since December 2014 and as the interim President and Chief Executive Officer from November 2016 to March 2017. He served as a director of TripAdvisor, Inc. from February 2013 to December 2015. Mr. Shean is a graduate of Virginia Polytechnic Institute and State University.

Board Membership Qualifications: Mr. Shean was nominated as a director by Liberty Expedia Holdings, which currently has the right to nominate three individuals for election to Expedia’s Board of Directors pursuant to the Governance Agreement. Mr. Shean has significant financial and operational experience gained through his service as Chief Financial Officer and other executive-level positions at Liberty Interactive, Liberty Media and Liberty Broadband and as a partner of KPMG LLP, as well as experience as a director serving on other public company boards. As a result of his extensive business and financial experience, Mr. Shean is able to provide valuable business, financial and risk management advice. He also possesses a high level of financial literacy and expertise regarding mergers, acquisitions, investments and other strategic transactions.

Alexander von Furstenberg

Mr. von Furstenberg has been a director of Expedia since December 2015. Mr. von Furstenberg currently serves as Chief Investment Officer of Ranger Global Advisors, LLC, a family office focused on value-based investing (“Ranger”), which he founded in June 2011. Prior to founding Ranger, Mr. von Furstenberg founded Arrow Capital Management, LLC, a private investment firm focused on global public equities, where he served as Co-Managing Member and Chief Investment Officer since 2003. Mr. von Furstenberg has served as a member of the Board of Directors of

Amadeus IT Group S.A.IAC since 2008, Liberty Expedia Holdings since November 2016, La Scogliera, an Italian financial holding company, since December 2016 and served as a member of the board of directors of W.P. Stewart & Co. Ltd., a

leading providerBermuda based asset management firm, until the company was acquired in December 2013. Since 2001, he has acted as Chief Investment Officer of

IT solutionsArrow Investments, Inc., the private investment office that serves his family. Mr. von Furstenberg also serves as a partner and Co-Chairman of the Board of Diane von Furstenberg Studio, LLC. In addition to the

travel and tourism industry.philanthropic work accomplished through his position as a director of The Diller-von Furstenberg Family Foundation, Mr.

Tazón served as Amadeus’ President and Chief Executive Officer from October 1990 until December 2008. Prior to joining Amadeus, Mr. Tazón worked at Iberian Airlines from 1975 until 1987, where he served as Headvon Furstenberg also serves on the board of

Systems Planning from 1983 until 1987. Mr. Tazón received advanced degrees in Telecommunications Engineering and Data Processing fromdirectors of Friends of the

Universidad Politécnica, Madrid, Spain.High Line.

Board Membership Qualifications:Qualifications:Mr. Tazónvon Furstenberg has extensive senior-level managementprivate investment and board experience, including eighteen yearswhich the Board believes give him particular insight into capital markets and investment strategy, as well as a chief executive officer. He also has a wealthhigh level of knowledge of the travel and tourism industry, including insight and understanding of technology solutions related to the industry, and a strong background in the global travel marketplace.financial literacy. Mr. von Furstenberg is Mr. Diller’s stepson.

Controlled Company Status. Expedia is subject to the NASDAQ Stock Market Listing Rules. These rules exempt “controlled companies,” or companies of which more than 50% of the voting power is held by an individual, a group or another company, such as Expedia, from certain requirements.Pursuant to an amended and restated stockholders agreement dated December 20, 2011 (the “Stockholders Agreement”), by and between Liberty Interactive and Mr. Diller, Mr. Diller generally controls the vote of shares that he owns as well as those shares beneficially owned by Liberty Interactive.

Based on information provided on a Schedule 13D filed by Mr. Diller and Liberty InteractiveExpedia Holdings, Inc. (“Liberty Expedia Holdings”), on November 14, 2016, and certain of their affiliates on a Statement of Beneficial Ownership on Schedule 13D/A, filed on October 8, 2014, a Form 4 filed by Mr.Barry Diller on March 15, 2013, and a Form 4 filed by Liberty Interactive on April 14, 2015 referencing shares subsequently purchased on April 21, 2015,February 24, 2017, Mr. Diller and Liberty InteractiveExpedia Holdings together beneficially own as of the record date, approximately 14%12% of the outstanding shares of common stock (or 24%approximately 19% assuming exercise of Mr. Diller’s vested stock options and conversion of all shares of Class B common stock into shares of common stock) and 100% of the outstanding shares of Class B common stock and, consequently, approximately 60%54% of the combined voting power of the outstanding Expedia capital stock.stock as of the record date. On this basis, Expedia is relying on the exemption for controlled companies from certain NASDAQ requirements, including, among others, the requirement that a majority of the Board of Directors be composed of independent directors, the requirement that the Compensation Committee be composed solely of independent directors and certain requirements relating to the nomination of directors. For further information on the Company’s relationship with Mr. Diller, see the section below titled “

Certain Relationships and Related Person Transactions— Relationships Involving Significant Stockholders, Named Executive Officers and Directors—Relationships Involving Mr. Diller”. For further information on the Company’s relationship with Liberty Expedia Holdings, see the section below titled “Certain Relationships and Related Person Transactions— Relationships Involving Significant Stockholders, Named Executive Officers and Directors—Relationships Involving Liberty Expedia Holdings”. Director Independence. The Board of Directors has determined that each of Mses. Athey and Clinton, and Messrs. Battle, Dolgen, Jacobson, Kern and TazónRudin is an “independent director” as defined by the NASDAQ listing rules. In making

its independence determinations, the Board considered the applicable legal standards and any relevant transactions, relationships or arrangements, including

nominal compensation paid to Ms. Athey for consulting services prior to her appointment to the Board, Ms. Clinton’s service as a member of IAC’s board of directors and political campaign contributions to a member of Ms. Clinton’s family by Company management, legal services provided to a subsidiary of IAC by the law firm in which Mr. Jacobson is a partner, and Mr.

Tazón’sRudin’s past business arrangements with subsidiaries of IAC and his service as

non-executive chairmanvice chair of

Amadeus, a

company withnon-profit organization for which

Expedia has a contractual relationship.Mr. Diller is the chairman.

The Board. The Board of Directors met fivefour times in 2014.2016. For 2014,2016, each then-serving director attended more than 75% of the meetings of the Board, and each then-serving director, other than Mr. Kaufman, attended more than 75% of the meetings of the Board committees on which they served. The independent directors meet in-9-

regularly scheduled sessions, typically before or after each Board meeting, without the presence of management. Directors are encouraged, but not required to attend annual meetings of Expedia stockholders. SixAll of the then-serving thirteen members of the Board of Directors attended the 20142016 Annual Meeting of Stockholders.

Board Leadership Structure. Mr. Diller serves as the Chairman and also serves as Senior Executive of the Company, and Mr. Khosrowshahi serves as Chief Executive Officer of the Company. The roles of Chief Executive Officer and Chairman of the Board are currently separated in recognition of the differences between the two roles. We believe that it is in the best interests of our stockholders for the Board to make a determination regarding the separation or combination of these roles each time it elects a new Chairman or appoints a Chief Executive Officer, based on the relevant facts and circumstances applicable at such time. Independent members of the Board chair our Audit, Compensation and Section 16 Committees. Expedia has had the current leadership structure since the completion of its spin-off from IAC in 2005. Board’s Role in Risk Oversight. As part of its general oversight duties, the Board of Directors oversees the Company’s risk management. The Chief Executive Officer, General Counsel and Chief Financial Officer and General CounselExecutive Vice President of Operations attend quarterly Board meetings and discuss operational risks with the Board. Management also provides quarterly reports and presentations on strategic risks to the Board. Between quarterly meetings, the General Counsel and Chief Financial Officer and General CounselExecutive Vice President of Operations meet regularly with the Executive Committee, and the members are informed of any immediate risks at such meetings. In addition, the Audit Committee is responsible for discussing with management the Company’s major financial risks and the steps management has taken to monitor and control such risks, including the Company’s risk assessment and risk management policies. The Audit Committee also has oversight responsibility for the Company’s foreign exchange risk management policy and investment management policy. In fulfilling its responsibilities, the Audit Committee receives regular reports from the Chief Financial Officer

and Executive Vice President of Operations, General Counsel, Vice President of Internal Audit, Treasurer,

Chief Technology OfficerPresident of eCommerce Platform (having responsibility for technology infrastructure and security) and Chief Accounting Officer.

In addition, the Committee reviews the results of the annual risk assessment survey of key company leaders. The Vice President of Internal Audit reports directly to the Audit Committee and provides quarterly (or more frequent) reports on the results of internal audits and investigations. The Chairman of the Audit Committee makes regular reports to the Board.

-10-

The Board of Directors has the following standing committees: the Audit Committee, the Compensation Committee, the Section 16 Committee and the Executive Committee. The Audit, Compensation and Section 16 Committees operate under written charters adopted by the Board of Directors. These charters are available on the “Corporate Governance” page of the “Investors” section of the Company’s corporate website at www.expediainc.com. www.expediainc.com.

The following table sets forth the

current members of each Committee and the number of meetings held by, and times that each such Committee took action by unanimous written consent, during

2014. Each Committee member identified below served in2016. There were no changes to the

capacities set forth below formembership of any committees during all of

2014. | | | | | | | | |

Name | | Audit

Committee | | Compensation

Committee | | Section 16

Committee | | Executive

Committee |

Barry Diller | | — | | — | | — | | X |

Victor A. Kaufman | | — | | — | | — | | X |

Dara Khosrowshahi | | — | | — | | — | | X |

A. George “Skip” Battle(1) | | X (Chair) | | — | | — | | — |

Pamela L. Coe | | — | | X | | — | | — |

Jonathan L. Dolgen(1) | | — | | X (Chair) | | X (Chair) | | — |

Craig A. Jacobson(1) | | X | | X | | X | | — |

Peter M. Kern(1) | | X | | X | | X | | — |

John C. Malone | | — | | — | | — | | — |

José A. Tazón(1) | | — | | — | | — | | — |

Number of Meetings | | 7 | | 7 | | 7 | | 8 |

Number of Unanimous Written Consents | | 0 | | 1 | | 1 | | 0 |

|

| | | | |

| Name | Audit Committee | Compensation Committee | Section 16 Committee | Executive Committee |

| Barry Diller | — | — | — | X |

| Victor A. Kaufman | — | — | — | X |

| Dara Khosrowshahi | — | — | — | X |

Susan C. Athey(1) | — | — | — | — |

A. George “Skip” Battle(1) | X (Chairman) | — | — | — |

Chelsea Clinton(1) | — | — | — | — |

| Pamela L. Coe | — | X | — | — |

|

| | | | |

| Name | Audit Committee | Compensation Committee | Section 16 Committee | Executive Committee |

Jonathan L. Dolgen(1) | — | X (Co-Chair) | X (Co-Chair) | — |

Craig A. Jacobson(1) | X | X | X | — |

Peter M. Kern(1) | X | X (Co-Chair) | X (Co-Chair) | — |

| John C. Malone | — | — | — | — |

Scott Rudin(1) | — | — | — | — |

| Christopher W. Shean | — | — | — | — |

| Alexander von Furstenberg | — | — | — | — |

| Number of Meetings | 10 | 7 | 7 | 5 |

| Number of Unanimous Written Consents | 0 | 1 | 1 | 2 |

Audit Committee. Each current Audit Committee member satisfies the independence requirements for Audit Committee members under the current standards imposed by the rules of the SEC and NASDAQ. The Board has determined that each of Messrs. Battle and Kern is an “audit committee financial expert,” as such term is defined in the regulations promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”“Exchange Act”). The Audit Committee functions pursuant to a written charter adopted by the Board, pursuant to which the Audit Committee is granted the responsibilities and authority necessary to comply with Rule 10A-3 of the Exchange Act. The Audit Committee is appointed by the Board to assist the Board with a variety of matters discussed in detail in the charter, including monitoring: (i) the integrity of the Company’s financial reporting process, (ii) the independent registered public accounting firm’s qualifications and independence, (iii) the performance of Company’s internal audit function and the independent registered public accounting firm, and (iv) the Company’s compliance with legal and regulatory requirements.

The formal report of the Audit Committee with respect to the year ended December 31,

2014,2016, is set forth under the heading “Audit Committee Report” below.

Compensation Committee. With the exception of Ms. Coe, each member satisfies the independence requirements for Compensation Committee members under the current standards imposed by the rules of the SEC and NASDAQ. No member of the Compensation Committee is an employee of Expedia. The Compensation Committee is responsible for (i) administering and overseeing the Company’s executive compensation program, including salary matters, bonus plans and stock compensation plans, and (ii) approving all grants of equity awards, but excluding matters governed by Rule 16b-3 under the Exchange Act (see section below titled “Section“Section 16 Committee”Committee”). A description of the Company’s processes and procedures for the consideration and determination of executive compensation is included in the section below titled “Compensation Discussion and Analysis.”-11-

Section 16 Committee. Each member of the Section 16 Committee is an “independent director” as defined by the NASDAQ listing rules and satisfies the definition of “non-employee director” for purposes of Section 16 of the Exchange Act. The Section 16 Committee is authorized to exercise all powers of the Board of Directors with respect to matters governed by Rule 16b-3 under the Exchange Act, including approving grants of equity awards to Expedia’s executive officers. Mr. Dolgen is the Chairman of the Section 16 Committee. Compensation Consultant Independence. During 2014,2016, management retained Compensia, Inc., a compensation consulting firm, to conduct a review of Expedia’s compensation peer groups, and to compile data from proxy statements and other SEC filings of peer companies regarding compensation for certain executive officer positions. Neitherpositions and provided Compensia nor any other compensation consultant had any role in determining or recommending the amount or form of executive compensation for 2014.instruction and direction consistent therewith. The Compensation Committee considered various factors bearing upon Compensia’s independence including, but not limited to, the amount of fees received by Compensia from Expedia as a percentage of Compensia’s total revenue, Compensia’s policies and procedures designed to prevent conflicts of interest, and the existence of any business or personal relationship that could impact Compensia’s independence. After reviewing these and other factors, the Committee determined that Compensia was independent and that its engagement did not present any conflicts of interest. Compensation Policies and Practices Risk Assessment. Consistent with SEC disclosure requirements, management has assessed compensation policies and practices for Company employees and has concluded that such policies and practices do not create risks that are reasonably likely to have a material adverse effect on the Company.

Executive Committee. The Executive Committee has all the power and authority of the Board of Directors, except those powers specifically reserved to the Board by Delaware law.

Given the ownership structure of the Company and its status as a “controlled company,” the Board of Directors does not have a nominating committee or other committee performing similar functions or any formal policy on director nominations. Pursuant to the Governance Agreement, Liberty

InteractiveExpedia Holdings has the right to nominate a number of directors equal to 20% of the total number of the directors on the Board of Directors (rounded up to the next whole number if the number of directors on the Board is not an even multiple of five) for election to the Board so long as certain stock ownership requirements are satisfied. The Board does not have specific requirements for eligibility to serve as a director of Expedia, nor does it have a specific policy on diversity. However, in evaluating candidates, regardless of how recommended, the Board considers whether the professional and personal ethics and values of the candidate are consistent with those of Expedia, whether the candidate’s experience and expertise would be beneficial to the Board in rendering service to Expedia, including in providing a mix of Board members that represent a diversity of

backgrounds, perspectivesexperiences, characteristics, attributes, skills and

opinions,backgrounds, whether the candidate is willing and able to devote the necessary time and energy to the work of the Board, and whether the candidate is prepared and qualified to represent the best interests of Expedia’s stockholders. Given the controlled status of Expedia, the Board believes the process described above is appropriate. Liberty

InteractiveExpedia Holdings has nominated

Ms. Coe, Dr. Malone, and

Ms. CoeMr. Shean as nominees for

2015.2017. The other nominees to the Board were recommended by the Chairman and then were considered and recommended by the entire Board.

The Board of Directors does not have a formal policy regarding the consideration of director candidates recommended by stockholders, as historically Expedia has not received such recommendations. However, the Board would consider such recommendations if made in the future. Stockholders who wish to make such a recommendation should send the recommendation to Expedia, Inc., 333 108th Avenue N.E., Bellevue, Washington 98004, Attention: Secretary. The envelope must contain a clear notation that the enclosed letter is a “Director Nominee Recommendation.” The letter must identify the author as a stockholder, provide a brief summary of the candidate’s qualifications and history and be accompanied by evidence of the sender’s

stock-12-

ownership,stockownership, as well as consent by the candidate to serve as a director if elected. Any director candidate recommendations will be reviewed by the Secretary and, if deemed appropriate, forwarded to the Chairman for further review. If the Chairman believes that the candidate fits the profile of a director nominee as described above, the recommendation will be shared with the entire Board.

Communications with the Board